Micron Q3 Earnings: AI-Driven HBM Chip Growth and Challenges

Introduction

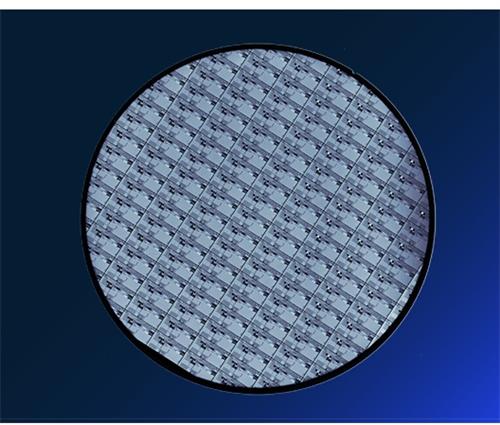

As a global leader in memory device supply, Micron Technology has demonstrated significant business growth in its Q3 earnings report, propelled by the wave of artificial intelligence (AI). However, despite exceeding expectations in performance, the company still faces challenges in the production capacity of High Bandwidth Memory (HBM) chips and sluggish demand in traditional markets.

Earnings Overview

Micron Technology's Q3 earnings report showcased robust revenue growth, with adjusted revenue reaching $6.81 billion, a year-over-year increase of 82%, surpassing analysts' expectations of $6.67 billion. Profit per share was 62 cents, also better than the expected 50 cents. Nevertheless, for the Q4 revenue forecast, although the midpoint of $7.6 billion is slightly higher than the average analyst estimate of $7.58 billion, it failed to meet the market's extremely high expectations, with some analysts having anticipated a figure above $8 billion.

Growth and Production Capacity Challenges of HBM Chips

● Strong Performance of HBM Chips

Micron Technology's HBM3 chips achieved revenue of $100 million in the third quarter and are expected to rise to several hundred million dollars in the fourth quarter. The company also forecasts that by the fiscal year 2025, the revenue from HBM chips will increase to several billion dollars. This growth is attributed to the rapid development of AI technology, especially the surging demand in data centers and high-performance computing fields.

● Limitations on Production Capacity Growth

Despite strong demand for HBM chips, Manish Bhatia, Executive Vice President of Global Business at Micron Technology, pointed out that the growth in HBM supply has effectively "hit the brakes" due to difficulties in increasing factory output and integrating chips with system usage. This production capacity constraint also indicates that HBM prices will steadily rise.

Investment and Future Planning

To address the production capacity challenge, Micron Technology plans to invest about $8 billion in the fiscal year 2024 for new factories and equipment, especially for the construction of factories in Idaho and New York. However, the benefits of these investments are expected to materialize in the fiscal years 2027 and 2028.

Sluggish Demand in Traditional Markets

In stark contrast to the hot demand for HBM chips, the demand for chips in traditional markets such as PCs and smartphones from Micron Technology remains sluggish. CEO Sanjay Mehrotra emphasized in the earnings statement that the recovery of demand in the smartphone and personal computer markets still needs time. Although it is expected that by 2024, PC and smartphone sales will have a slight increase, this growth rate is far lower than the expectations of the HBM chip market.

Future Outlook

Despite facing production capacity challenges and sluggish demand in traditional markets, Micron Technology's Q3 earnings report still shows the company's strong growth momentum. With the continuous advancement of AI technology, it is expected that by 2025, AI functions will stimulate the demand for mobile phones and personal computers, bringing new growth opportunities for Micron Technology. CEO Sanjay Mehrotra's forecast for the rebound of the memory chip industry in 2024 and the record sales in 2025 further demonstrates the company's optimistic attitude towards future development.

Recommended Models

● BQ4050RSMR is a by Texas Instruments in the production of battery management chip. Has an interface to communicate with the host system in order to transmit battery information to the processor or display unit of the device. It is commonly used in battery packs in laptops, tablets and other portable devices.

● TLV320AIC23BIPWR is a high performance stereo audio Codec chip from Texas Instruments(TI) that is used in applications such as portable digital audio players and recorders. Multiple analog functions are integrated with an integrated tunable microphone amplifier (gain adjustable from 1 to 5) and a programmable gain microphone amplifier (0 dB or 20 dB). This makes it ideal for low-power audio applications, especially for portable digital audio players and recorders.

● The K4B2G1646F-BYMA is a DDR3 DRAM (Dynamic Random access memory) from Samsung. The chip is designed as a 16Mbit x16 I/O x8 bank device, and for general applications, it is capable of high-speed double data rate transfer rates up to 1866Mbc/pin (DDR3-1866). It is used in a wide variety of computing environments, including personal computers, home appliances, automobiles, and medical devices.

Website: www.conevoelec.com

Email: info@conevoelec.com