TSMC Q2 2024 Performance Analysis: Technological Leadership and Market Confidence

In the global semiconductor industry competition, TSMC has once again proven its leadership with its outstanding technology and strong market performance. In the second quarter of 2024, TSMC not only set new records for revenue and net profit but also made significant progress in advanced process technology and market expansion.

Performance Overview

TSMC's consolidated revenue for the second quarter of 2024 reached NT$673.51 billion (approximately RMB 150.462 billion), a year-on-year increase of 40.1%. The net profit was NT$247.85 billion (approximately RMB 55.37 billion), a year-on-year increase of 36.3%. This performance not only exceeded analysts' expectations but also demonstrated TSMC's strong profitability and operational efficiency. The gross margin was 53.2%, the operating profit margin was 42.5%, and the net profit margin was 36.8%.

Technology and Business Highlights

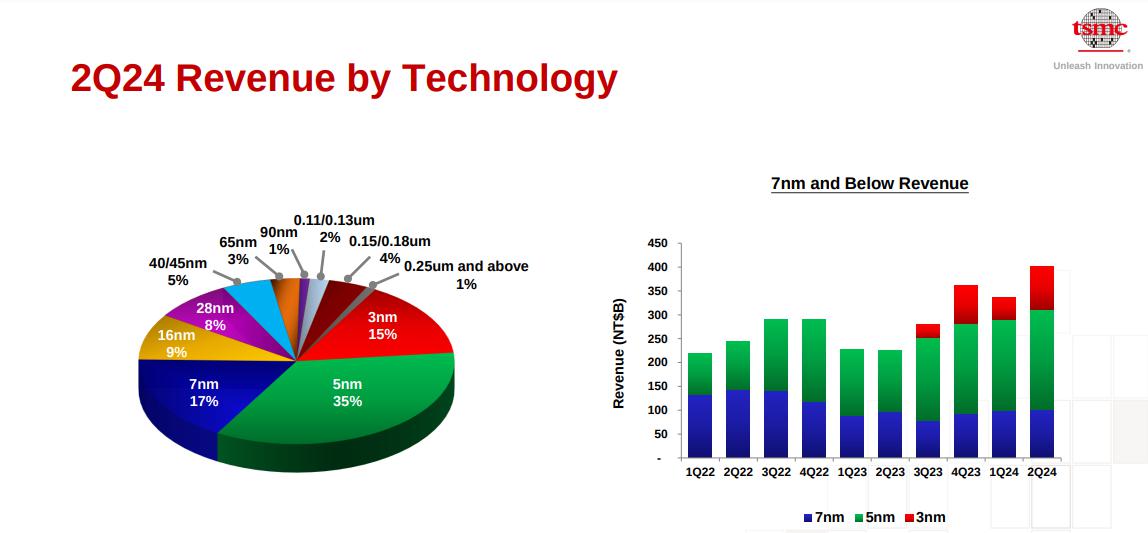

TSMC's leading position in advanced process technology is a key factor in its revenue growth. The 3-nanometer (nm) process technology contributed 15% of the wafer sales revenue in the second quarter, while the 5nmr process accounted for 35% of the total wafer sales revenue for the quarter, and the 7nm process contributed 17%. This indicates that TSMC's advanced process (including 7nm and more advanced technology) revenue accounted for 67% of the total wafer sales revenue for the quarter.

TSMC's customer base is extensive, including tech giants such as Apple, Qualcomm, Nvidia, and AMD. Among them, the 3nm process was first used on a large scale in Apple's A17 Pro chip, showing the strong market demand for high-end chips. This broad customer base and market demand provide a solid foundation for TSMC's continued growth.

Future Outlook

TSMC Chairman and President Wei Zhejia said that the demand for 3nm chips is very strong, and there is no exclusion of converting more 5nm processes to 3nm. In addition, the N2 factory responsible for the 2nm process technology is currently progressing smoothly, and the 2nm process is planned to be mass-produced in 2025. These technological innovations and capacity expansion plans will further consolidate TSMC's leading position in the global semiconductor industry.

AI chips drive the continuous strong demand for TSMC's CoWoS advanced packaging, and it is expected that the CoWoS production capacity will double in the next two years, with the aim of achieving a supply-demand balance by 2026. The progress in packaging technology not only enhances TSMC's product competitiveness but also provides new possibilities for future technological development.

TSMC has adjusted its capital budget for 2024 from the previous range of $28 billion to $32 billion to $30 billion to $32 billion. Most of the funds will be used for the research and development and production of advanced process technology and special process technology. This large-scale investment shows TSMC's firm confidence and commitment to future technological development.

Conclusion

TSMC's performance in the second quarter of 2024 not only demonstrates its strong strength in technology and market but also provides a positive signal for the future development of the semiconductor industry. With the continuous development of new technologies and the expansion of production capacity, TSMC is expected to continue to maintain its leading position in the semiconductor industry and promote the sustained growth of the entire industry.

Electronic IC Components

● The 1N4148W-7-F is a high-performance three-terminal bidirectional trigger diode (DIAC) produced by Diodes Incorporated. This diode is widely used in various electronic devices because of its high precision, small size and low power consumption. The 1N4148W-7-F is suitable for signal processing, general switching applications and many other scenarios. Its fast switching speed and low capacitance value make it excellent in signal processing and switching circuits.

● The XC7A200T-2FBG484I is a high-performance FPGA (Field Programmable Gate Array) produced by AMD (formerly Xilinx). This FPGA is part of the Artix-7 series and uses advanced 28nm process technology, featuring high performance and low power consumption. The XC7A200T-2FBG484I is suitable for a variety of applications with high performance and low power requirements, including but not limited to: signal processing, data buffering, clock management, analog interfaces, and digital signal processing.

● The RC0603FR-071KL is a high performance chip resistor manufactured by Yageo Corporation. This resistor is widely used in various electronic devices due to its high precision, small size and low power consumption. The RC0603FR-071KL is suitable for use in a variety of consumer-grade electronic devices, including but not limited to signal processing, power management, sensor applications, and communication devices.

Website: www.conevoelec.com

Email: info@conevoelec.com