Global Semiconductor Market Rebounds, Top Four Foundries Q2 Financial

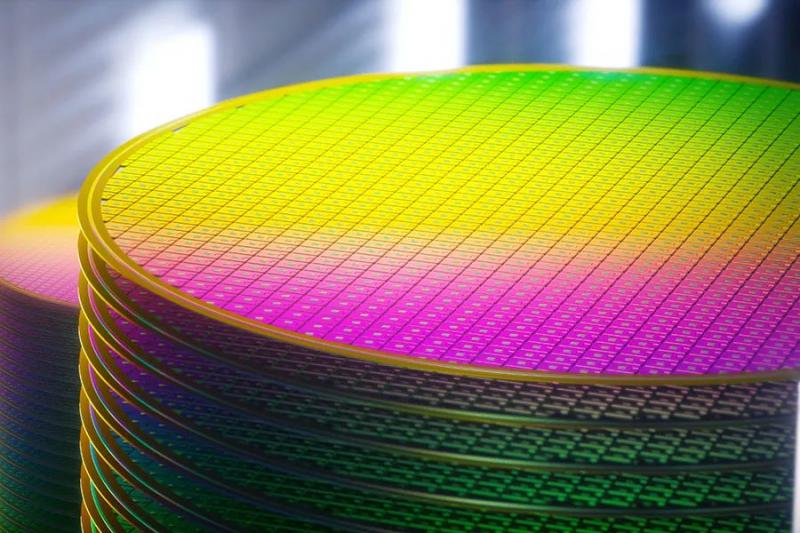

Amidst the sustained recovery and revitalization of the global semiconductor industry, the second-quarter financial reports for 2024 from the four major chip foundries—TSMC, SMIC, UMC, and GF—not only reveal their individual operating performances but also mirror the vibrant vitality and subtle shifts within the entire sector.

TSMC: Leading the Advanced Process Frontier, Solidifying Industry Dominance

As a preeminent player in the semiconductor foundry space, TSMC's remarkable second-quarter financial performance once again underscores its exceptional capabilities in technological leadership and market demand anticipation. With revenue soaring to 20.82 billion, a year−on−year increase of 32.8%, marking a 9.9% sequential growth. This significant growth stems from the explosive demand for high-performance chips in AI and high-performance computing domains, particularly its 3nm and 5nm process technologies, which contributed 15% and 35% respectively to total wafer revenue, serving as key drivers for its performance. TSMC has not only solidified its leadership position in advanced process technologies but also achieved comprehensive success by continually optimizing its product mix and enhancing capacity utilization. Looking ahead, with the sustained prosperity of the AI and smartphone markets, TSMC is poised to maintain its high-growth trajectory.

SMIC: Balanced Growth, Highlighting Domestic Market Competitiveness

SMIC's second-quarter performance is equally commendable, with revenue reaching $1.901 billion, a year-on-year increase of 21.8%. Although net profits declined 59.1% compared to the previous year, they surged by an impressive 129.2% sequentially, demonstrating a robust recovery momentum. This growth is primarily attributed to the increased revenue contributions from smartphones and consumer electronics applications, coupled with a notable expansion in 12-inch wafer capacity. SMIC's balanced development across multiple sectors, including smartphones and consumer electronics, has not only enhanced the stability of its business structure but also bolstered its competitiveness in both global and domestic markets. Moreover, its continuous investments and capacity expansions in advanced wafer manufacturing have laid a solid foundation for its future growth.

UMC: Steady Progress, Driven by Market Demand

UMC, the second-largest wafer foundry in Taiwan, also demonstrated a steady growth trajectory in its second-quarter financial results. With revenue reaching $1.75 billion, exceeding market expectations, despite a 13.35% year-on-year decline in net profits, wafer shipments increased 2.6% quarter-on-quarter, and capacity utilization improved to 68%. This growth is primarily fueled by the growing demand for consumer products, particularly the sustained increase in revenue contributions from 22nm and 28nm wafers. By flexibly adjusting its product mix and enhancing capacity utilization, UMC has effectively navigated market changes, setting a solid foundation for future growth.

GF: Facing Challenges, Seeking Transformation and Breakthroughs

In contrast to the other three, GF's second-quarter performance was somewhat subdued. Revenue stood at $1.632 billion, a year-on-year decrease of 12%, with net profits also down 35%. This decline is primarily due to the cyclical downturn in consumer, industrial, and automotive customer businesses, resulting in reduced market demand. Nevertheless, GF remains undeterred and is actively pursuing transformation and breakthroughs. During the reporting period, the company acquired Tagore Technology's gallium nitride (GaN) business, aiming to expand its power IP portfolio and strengthen its competitiveness in the rapidly expanding GaN power device sector. This strategic move is expected to bring new growth opportunities for GF, helping it emerge from its current predicament.

IC Industry Outlook

Global semiconductor market achieved a 18.3% growth in the second quarter of 2024, with sales reaching $149.9 billion. Notably, the Chinese market led the way with a 21.6% growth rate. The quarterly ring increase of 7.1% in global silicon wafer shipments further validates the recovery trend in the semiconductor market. With the resurgence of demand in AI, consumer electronics, communications, and smartphones, foundries are poised to embrace new development opportunities. Particularly in advanced process technologies, as these technologies continue to mature and expand into new application areas, foundries are anticipated to achieve even higher revenue growth and market share gains. Meanwhile, amidst intensifying market competition and evolving customer needs, foundries must continually innovate and optimize their product portfolios to meet.

Global semiconductor market achieved a 18.3% growth in the second quarter of 2024, with sales reaching $149.9 billion. Notably, the Chinese market led the way with a 21.6% growth rate. The quarterly ring increase of 7.1% in global silicon wafer shipments further validates the recovery trend in the semiconductor market. With the resurgence of demand in AI, consumer electronics, communications, and smartphones, foundries are poised to embrace new development opportunities. Particularly in advanced process technologies, as these technologies continue to mature and expand into new application areas, foundries are anticipated to achieve even higher revenue growth and market share gains. Meanwhile, amidst intensifying market competition and evolving customer needs, foundries must continually innovate and optimize their product portfolios to meet.

Conevo Intergrated Cricuit Component

● The RB551V-30TE-17 is a Schottky diode manufactured by ROHM with high performance rectification capabilities and is widely used in computers, mobile phones and other portable electronic products. The RB551V-30TE-17 features a low forward voltage drop (VF), high reliability, and small package. The RB551V-30TE-17 is surface mount and suitable for environmentally stringent applications.

● The XC5VSX95T-1FFG1136C is a high-performance field-programmable gate array (FPGA) device manufactured by Xilinx Corporation, part of the Virtex®-5 SXT family. The XC5VSX95T-1FFG1136C FPGA has 640 input/output (I/O) ports, 7360 configurable logic blocks (CLBs), up to 94,208 logical units, and a total RAM bit of 8994,816. The FPGA is designed for high performance applications and is widely used in areas where high performance and high logic integration are required.

● The M95256DWMN3T is an electrically erasable programmable read-only memory (EEPROM) manufactured by STMicroelectronics with a storage capacity of 256 Kbit, or 32 Kbytes, organized in 8-bit data widths. The M95256DWMN3T EEPROM supports clock frequencies up to 20 MHz and provides a single supply voltage range between 1.8V and 5.5V, which can be adapted to different power requirements. The EEPROM is widely used in fields requiring non-volatile storage, such as industrial control, automotive electronics, medical equipment, intelligent instruments, etc.

Website: www.conevoelec.com

Email: info@conevoelec.com