DDR Memory market Evolution: The inevitable Path From DDR4 to DDR5

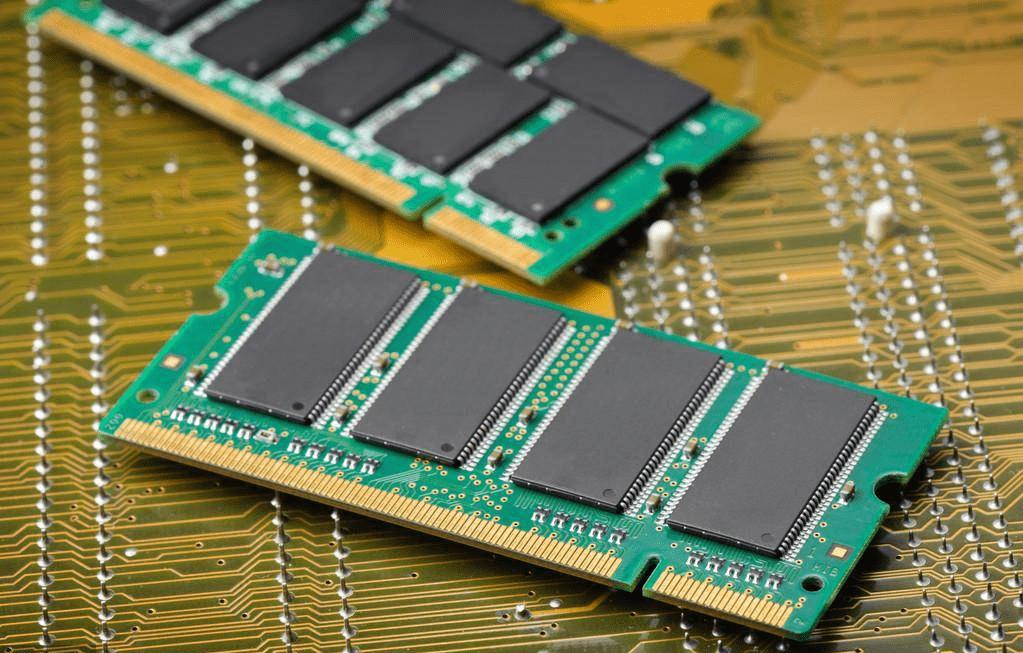

Memory, as a core component of computer systems, bears the crucial tasks of data storage and rapid retrieval. Since its debut in 2000, DDR memory (Double Data Rate memory) technology has become mainstream due to its advantage of double data transfer rates. DDR memory technology has continually evolved, from DDR1 to the current DDR4 and the soon-to-be-released DDR5. Each technological innovation has been accompanied by performance enhancements and broader application scopes. According to a recent survey, despite the emergence of DDR5 memory technology, DDR4 memory still dominates the market, with 58.2% of users utilizing DDR4, while only 32.5% use DDR5. This result reflects the current status of the DDR memory market: DDR4 remains mainstream, and the market penetration of DDR5 is not as high as expected, leaving room for growth.

The Arrival of the DDR5 Era and the Gradual Exit of DDR4

With technological advancements, DDR5 memory technology has continuously progressed, with frequencies reaching about 8000MHz and the potential to exceed 11000MHz in the future. However, DDR5 is priced higher, leading ordinary consumers to prefer the more economical DDR4. Yet, support for DDR4 memory on new platforms will not persist indefinitely; eventually, DDR5 will become exclusive.

Intel's newly released Arrow Lake-S desktop processors and 800-series chipset motherboards have announced support exclusively for DDR5 memory. AMD has also followed suit, announcing that its Ryzen 7000 series processors will no longer be compatible with DDR4 memory. Although there is still a significant inventory of electronic products supporting DDR4 in the market, and the relatively high price of DDR5 makes consumers lean towards DDR4 when making choices, it is undeniable that with continuous technological advancements and gradually decreasing costs, DDR5 will ultimately become the mainstream in the future memory market.

Strategic Adjustments by Storage Giants

Both Samsung and SK Hynix have stated that they will allocate more resources to the development of high-profit, high-end products, potentially leading to a reduction in the production of traditional DRAM and NAND flash memory products. This strategic adjustment reflects the current market's strong demand for high-performance storage solutions. SK Hynix plans to gradually scale down DDR4 memory production. In the third quarter of this year, DDR4 memory accounted for 30% of its product portfolio, down from 40% in the previous quarter, with expectations of further decreasing to 20% in the fourth quarter. Samsung has announced plans to cut DDR4 production capacity while shifting some of it to the production of advanced products such as DDR5 and LPDDR5.

Conclusion

As storage giants reduce production focus, DDR4 memory is gradually being phased out, while DDR5 memory technology is progressively replacing DDR4 as the new favorite in the market. Although DDR4 memory will still occupy a certain market share in the short term, with technological advancements and cost reductions, DDR5 memory will gradually become mainstream. This transition not only demonstrates enterprises' keen insights into market trends but also underscores their commitment to continuous technological innovation and product upgrades.

Get controller ic, Find in Conevo

● The Texas Instruments LM5060MMX/NOPB is a high-side protection controller designed for intelligent control of a high-side N-channel MOSFET during normal on/off transitions and fault conditions, featuring a wide input voltage range of 5.5 V to 65 V, low quiescent current, and adjustable undervoltage lockout with hysteresis.

● The STMicroelectronics BTA41-600BRG is a high-power TRIAC with a 600V rating, designed for general-purpose AC switching and capable of handling up to 400A with low thermal resistance and compliance with RoHS standards.

● The TL431ACDBVR from STMicroelectronics is a precision shunt-adjustable voltage reference IC with an output voltage range of 2.495V to 36V, housed in a SOT-23-5 package, and is known for its 1% initial accuracy and low temperature coefficient, making it suitable for a variety of voltage reference applications.

Website: www.conevoelec.com

Email: info@conevoelec.com