NAND Flash Oversupply, Major Manufacturers Like SK Hynix Announce Production Cuts

In the current severe situation of oversupply in the global NAND flash memory market, flash memory prices have continued to decline. According to related news, SK Hynix has announced that it will join the ranks of manufacturers cutting NAND flash production, planning to reduce NAND flash production by 10% in the first half of 2025 to alleviate market inventory pressures and stabilize prices.

Major Storage Manufacturers Cut NAND Flash Production

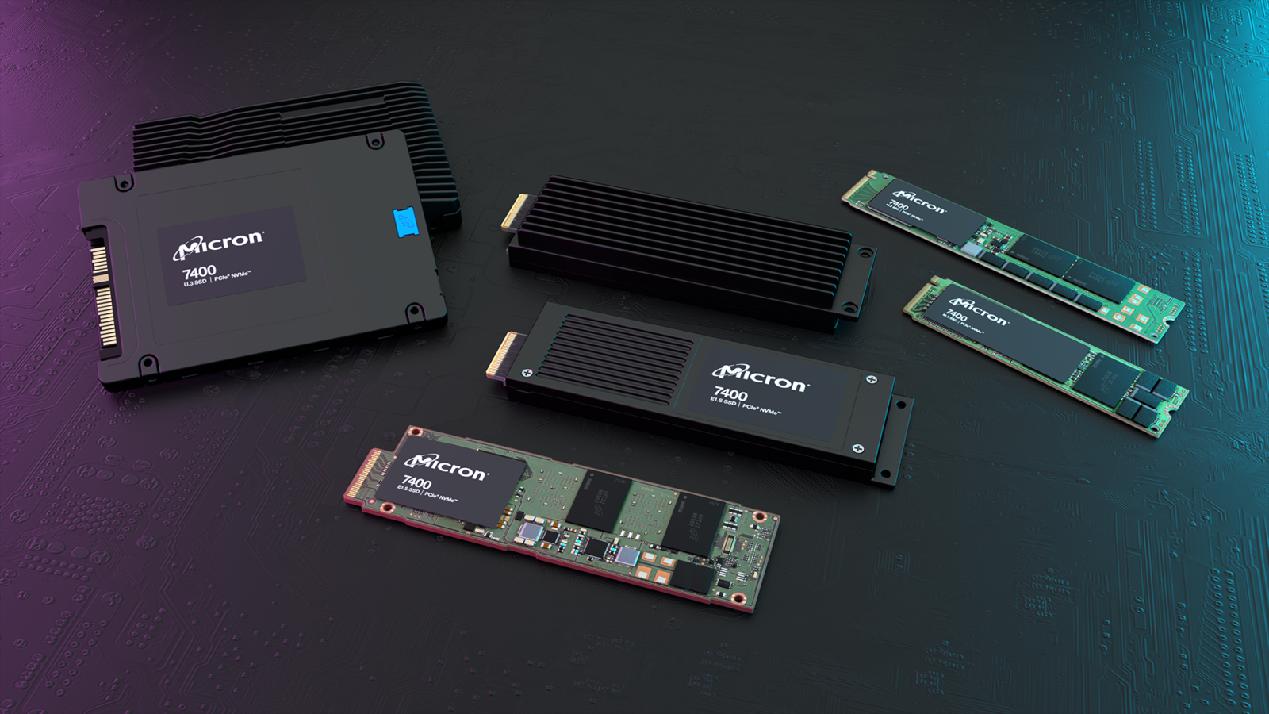

In fact, this production cut is not an isolated incident. Earlier, storage giants such as Micron, Samsung, and Kioxia had also made similar decisions. Micron Technology was the first company to announce adjustments to production volumes, reducing planned investments in NAND devices and slowing down the migration of technology nodes, with production decreased by approximately 10%. Subsequently, Samsung decided to adjust its NAND flash production in South Korea and the operating rate of its chip factory in Xi'an, China. Kioxia of Japan is also expected to make similar adjustments.

According to official news from SK Hynix, the company plans to reduce its NAND flash production by 10% in the first half of 2025. With a total NAND flash production capacity of 300,000 wafers per month, this production cut is expected to have a positive impact on the market, helping to alleviate the current issue of oversupply.

Oversupply in the NAND Flash Market

Global NAND flash memory prices have fallen for four consecutive months, a trend mainly influenced by decreasing demand for terminal devices such as smartphones and laptops. Data from market research firm TrendForce shows that prices for NAND flash used in general purposes such as memory cards and USB drives have fallen from 4.90inAugustto2.08. This price change not only reflects the weakness in market demand but also highlights the difficulties faced by storage chip manufacturers in the current market environment.

Although prices for solid-state drives (eSSDs) targeted at AI data centers remain relatively stable, their future trend is uncertain. Last month, Micron Technology stated that it had observed a decline in short-term demand for eSSDs for AI data centers. This trend may indicate that the future storage chip market will face a more complex and volatile demand environment.

SK Hynix's Storage Layout

However, SK Hynix still has layouts in other storage areas. The company's new Fab plant and business facility construction in Yongin, South Korea, is partly aimed at meeting the demand for AI-oriented semiconductor memory, including HBM products. The project is expected to be completed in May 2027 with an investment of approximately 9.4 trillion Korean won. In addition, SK Hynix is building the M15X wafer fab in Cheongju, North Chungcheong Province, South Korea, as a new large-scale production base for DRAM storage chips. Although the project primarily focuses on the DRAM field, HBM, as a high-end storage solution, is also a key focus.

In summary, facing the challenge of oversupply in the global NAND flash memory market, storage chip manufacturers such as SK Hynix are actively taking measures to respond to market changes. By cutting production, adjusting production plans, and investing in high-end storage solutions, these companies are striving to stabilize market prices and seek future development opportunities. In the future, with the continuous changes in market demand and technological advancements, the storage chip market will still face numerous challenges and opportunities.

Conevo storage ics

Conevo Elec is a reliable semiconductor component distributor, offering a wide range of IC electronic components. Here are some popular choices of integrated circuit chips.

1. The Samsung's K4B2G1646F-BYMA is a DDR3 DRAM (dynamic random access memory). The chip is designed as a 16Mbit x16 I/O x8 bank device, and for general applications, it is capable of high-speed double data rate transfer rates up to 1866Mbc/pin (DDR3-1866).

2. The MB85RS64PNF-G-JNERE1 is a ferroelectric Random access memory (FRAM) IC manufactured by Fujitsu Semiconductor that features non-volatility, high read/write speed and high durability. MB85RS64PNF-G-JNERE1 is mainly used in security systems, industrial control, medical equipment, automotive electronics and other fields, used in various fields of life.

3. The W25Q128JVSIQ is a flash memory chip produced by Winbond, with a capacity of 128 megabits (Mb), communication using SPI (Serial Peripheral interface), operating voltage between 2.7V and 3.6V, and operating temperature between -40°C and +85°C.

Website: www.conevoelec.com

Email: info@conevoelec.com