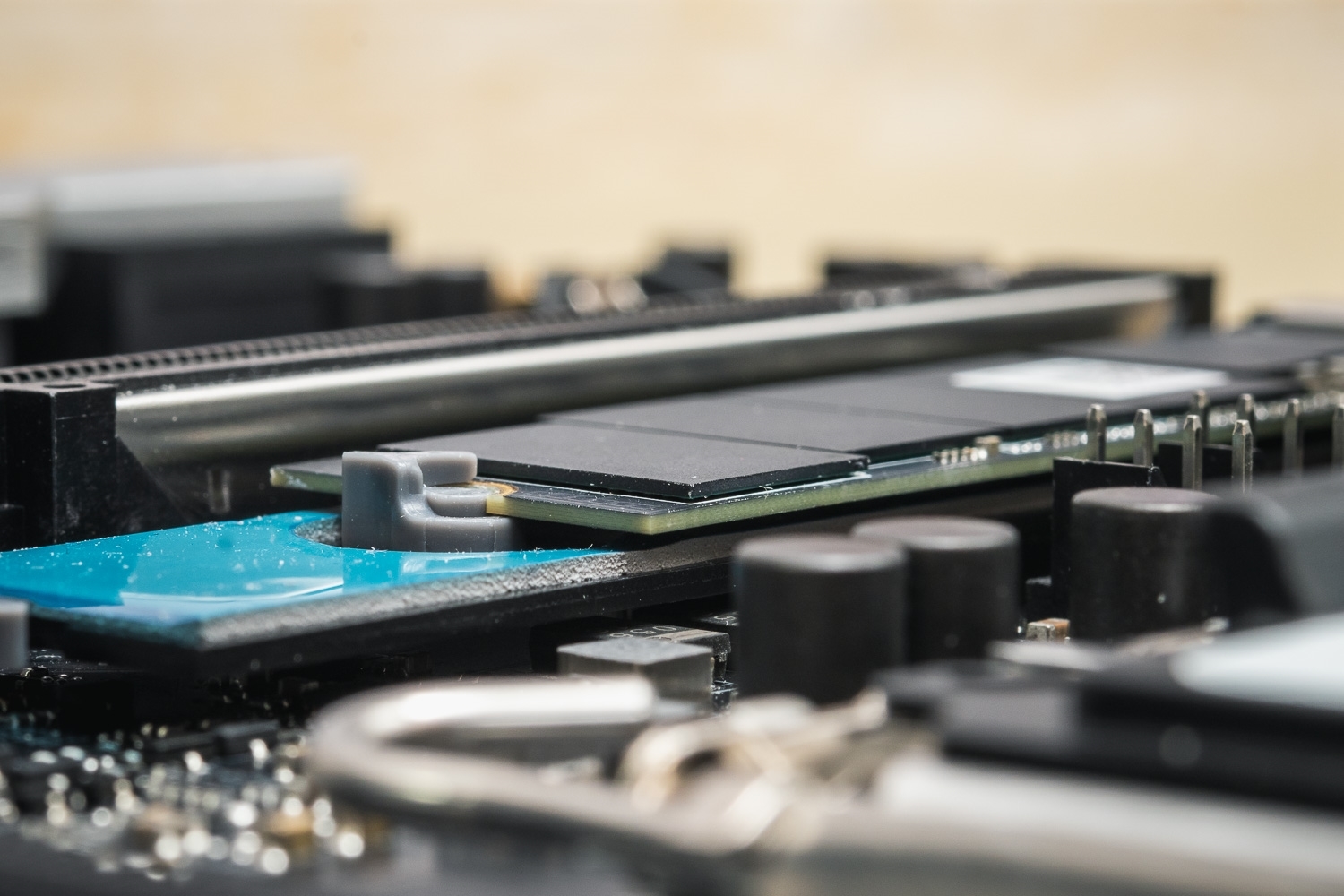

Storage Chip Market: Rising Prices Amid Supply Cuts and AI Demand

The global storage chip market is experiencing a significant price surge, with major players in the industry leading the charge. Micron and SanDisk have announced a comprehensive price increase for their channel and consumer products starting from April 1st, with an overall increase exceeding 10%. They also plan to continue adjusting prices in subsequent quarters. Meanwhile, South Korean memory giants Samsung and SK Hynix are expected to raise NAND prices next month. Phison, a leading NAND Flash controller chip manufacturer, anticipates that the first quarter of 2025 will mark the lowest point for NAND prices this year. With the rise in original factory prices and the growing demand for AI hardware, the supply and demand for NAND are expected to become tight in the second half of the year, leading to a better overall performance than last year.

The Drivers Behind the Price Surge

The current price increase in the storage chip market is primarily driven by two factors: production cuts and demand-side pull.

Firstly, production cuts have played a significant role in driving up prices. Since the fourth quarter of 2024, major manufacturers such as Samsung, SK Hynix, Micron, Western Digital, and Kioxia have reduced NAND production. Statistics show that in the first quarter of 2025, NAND Flash wafer production has decreased by 18% year-over-year, with Samsung's Xi'an factory operating at only 70% capacity. This reduction in production has led to a decrease in market supply, thereby pushing up prices.

Secondly, the demand-side pull cannot be overlooked. On one hand, smartphone manufacturers have nearly completed their inventory clearance, and with new phone launches expected in the second half of the year, the demand for mobile storage is gradually returning to normal. On the other hand, the rapid development of AI hardware has become a core driver of storage chip demand growth. For example, AI servers now require high-performance storage solutions, with HBM (High Bandwidth Memory) being widely used in AI training chips due to its high bandwidth and low power consumption. Additionally, emerging products such as AI glasses are also creating new demand for storage chips.

Market Reactions and Future Outlook

The price surge in the storage chip market has attracted widespread attention. SanDisk, which was the first to adjust prices, firmly believes that the supply-demand relationship in the storage industry is undergoing profound changes, and a supply shortage is expected soon. Moreover, tariff adjustments have also increased business costs for companies, further driving up product prices.

From an industry perspective, the storage chip supply chain is expected to bottom out and rebound. With the rapid development of AI technology, the demand for storage chips will continue to grow, especially for high-performance storage solutions. For example, the storage configuration requirements for AI servers have jumped from 8TB to 32TB. Meanwhile, domestic storage chip companies such as Yangtze Memory Technologies and Montage Technology are also benefiting from technological innovation and counter-cyclical investment strategies, gradually rising to prominence.

However, the price surge also brings some challenges. For downstream terminal manufacturers, the increase in storage chip costs may lead to higher prices for end products. Additionally, if manufacturers like Samsung restart production expansion, it could disrupt the current supply-demand balance. The uncertainty of technological iteration, such as the development of RISC-V architecture chips and quantum computing, may also pose a threat to the existing storage system.

Conclusion

The price surge in the storage chip market is not only a natural result of the industry cycle but also a prelude to a technological revolution. With the rapid development of AI technology and the growing demand for emerging products, the storage chip market is set to face new opportunities and challenges. For ordinary consumers, price fluctuations in electronic products such as smartphones and computers may become more evident. For investors, it is crucial to closely monitor the progress of domestic substitution and the structural opportunities brought about by the surge in AI demand.

Conevo Mmemory IC Supplier

At Conevo, your trusted global semiconductor partner, we excel in providing high-quality and cost-effective IC solutions tailored to your needs. From a single chip to a comprehensive range of components, our intuitive platform simplifies the sourcing process, ensuring you find the exact parts you need with ease. Experience seamless procurement and let Conevo enhance your supply chain today.

At Conevo, your trusted global semiconductor partner, we excel in providing high-quality and cost-effective IC solutions tailored to your needs. From a single chip to a comprehensive range of components, our intuitive platform simplifies the sourcing process, ensuring you find the exact parts you need with ease. Experience seamless procurement and let Conevo enhance your supply chain today.

● The LMV339IRUCR is a general-purpose, low-voltage comparator designed by Texas Instruments, featuring four independent channels with open-collector outputs. It operates within a supply voltage range of 2.7V to 5.5V, making it suitable for low-power and space-saving applications.

● The BTS4140NNT is a high-side power switch IC designed by Infineon Technologies, featuring an integrated N-channel vertical power MOSFET and providing embedded protection and diagnostic functions.

● The BQ24715RGRR is a highly efficient NVDC-1 synchronous battery charge controller designed by Texas Instruments, supporting 2-3 cell lithium-ion battery charging applications with ultra-fast transient response and high light-load efficiency. It features low quiescent current, programmable charge voltage, input/charge current, and minimal system voltage through an SMBus interface.

Website: www.conevoelec.com

Email: info@conevoelec.com