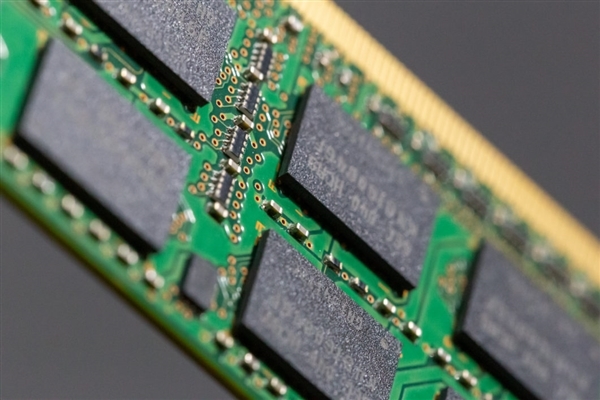

New Shift in the Memory Market! Samsung Ceases Production of DDR4

On April 22, 2025, Samsung Electronics officially notified its customers via letter that multiple DDR4 memory modules will reach the end of their product life cycle (EOL) by the end of 2025, with the final order date set for early June. The modules affected by the production halt include 8GB and 16GB capacities of SODIMM and UDIMM types, with the last shipment date scheduled for December 10th.

Background and impact of production suspension

The primary reason for this production halt is Samsung's accelerated shift of resources towards higher-end products such as DDR5 and LPDDR5, resulting in a significant reduction in the output of the older 1y-nanometer process. Products using 1y-nanometer 16Gb DDR4 chips will be the first to face a substantial decrease in supply. Although memory module manufacturers can still obtain some DDR4 chips from Samsung, the supply will remain tight.

In the long term, Samsung plans to rapidly reduce the production scale of the 1y-nanometer process in 2025. The 1z-nanometer process DDR4 will enter the EOL countdown in 2026, and by 2027, DDR4 chips will only be available in the 1z-nanometer process before being completely phased out. This transition will prompt PC OEMs to accelerate their upgrade to DDR5.

Additionally, in terms of supply strategy, Samsung will prioritize the supply of DDR5 modules using the 1a and 1b-nanometer processes to PC OEM customers such as Dell, HP, Asus, and Acer. Meanwhile, older process DDR4 chips will continue to be supplied to consumer or memory module customers.

Industry Trends and Dynamics of Other Manufacturers

Apart from Samsung, other major memory manufacturers are also adjusting their strategies. Micron has previously notified via letter that it will cease production of older process DDR4 modules for server applications, although other DDR4 products will still be supplied. SK Hynix has also been reported to reduce the proportion of DDR4 production to 20%, but the final production halt plan has not yet been determined.

According to analysis, the underlying motivations for Samsung's move include the significantly higher profit margins of higher-end products compared to DDR4, as well as the continuous expansion of production by Chinese mainland manufacturers, which has put pressure on DDR4 prices. One of the key reasons for the strategy adjustments by the three major manufacturers is to reduce inventory and losses while reallocating more production capacity to the manufacturing of DDR5 memory.

Market Outlook

As major manufacturers like Samsung gradually cease production of DDR4, the supply of DDR4 in the market will gradually decrease, which may lead to an upward trend in the prices of these products. For OEMs and end-users, this means they will face higher procurement costs, especially when transitioning to DDR5 memory.

Conevo Semiconductor Online Store

Conevo Electronics is your reliable partner for sourcing high-quality and cost-effective ICs and semiconductor components. With a wide range of popular IC chip models available, Conevo ensures you get the right components to meet your project needs. Whether you're looking for specific ic models or need expert advice, Conevo is here to support you.

1. The FAN23SV56AMPX is a 6A synchronous buck regulator designed for high-efficiency power conversion. It features a wide input voltage range from 7V to 24V and an adjustable output voltage from 0.6V to 5.5V. The regulator operates over a frequency range of 200kHz to 1.5MHz and is packaged in a 34-PowerTFQFN format, making it suitable for surface-mount applications.

2. The ST L99DZ100GTR is a high-performance, automotive-grade power management IC designed for electronic control units (ECUs), featuring a wide input voltage range, multiple output channels, and advanced protection features to ensure reliable operation in demanding automotive environments.

3. The Microchip AT24C512C-SSHM-T is a 512 Kbit (64 KByte) I²C-bus EEPROM with a page write capability, designed for reliable data storage in various applications, featuring a wide operating voltage range and a small SOIC-8 package.

Website: www.conevoelec.com

Email: info@conevoelec.com