A recent report speculates that the cost of 3nm and 2nm nodes will increase significantly in the future.

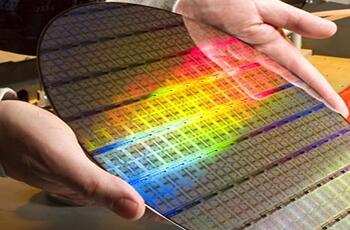

Back in 2022, a DigiTimes report suggested that TSMC's 3nm wafers would cost around $20,000, followed by several media reports suggesting that the cost per wafer could rise as high as $25,000 or fall below $20,000 per wafer.

By the end of 2023, demand for AI processors is picking up, so costing and the prospect of investing in expensive chip manufacturing facilities should be on every business planner's mind.

Artificial intelligence has pushed NVIDIA's valuation to an all-time high, while companies such as TSMC have maintained their value despite declining revenues due to the tough macroeconomic environment.

While the IBS report suggests that a 50 percent jump in the price of 2-nanometer products would have the biggest impact on Apple, companies including AMD and NVIDIA could also be tightening their budgets if the current wave of AI fully materializes in three years' time. In fact, NVIDIA is already selling A.I. products built on TSMC's powerful 5nm node, and if the experience is worthwhile, NVIDIA will have a chance to produce 3nm (if not more advanced) products by then.

Rumor has it that NVIDIA's next-generation GPUs will be built on a 3nm process, so Apple will be fully on the hook for the high cost of chips in the first wave of 2nm production. Because AMD and NVIDIA's processors and GPUs are more power-hungry and designed for heavy workloads, they are not typically subject to the high wafer costs associated with the initial mass production of advanced chip technologies.

However, supply and demand dynamics in the semiconductor market will likely mean that the price of AI chips will also soar. 3-nanometer wafers priced at $20,000 could become even more expensive if demand for them exceeds installed capacity - a warning unique to the chip industry. Companies such as TSMC and Samsung have fixed capacity, and if they are convinced that supply is outstripping demand, then the initial cost of investing in new equipment is often passed on to customers as well.

TSMC, in particular, must be thinking twice before overexpanding production after last year's nightmare. Not only has TSMC revised its revenue forecast for 2023 several times, but the Taiwanese company has also had to deal with overly optimistic customer expectations in 2022 amid a general slowdown in its chip business.